ALBANA SHEHAJ

What drives recent changes in the landscape of foreign direct investments (FDI) in Western Balkan states and what are the socioeconomic implications of such changes? The emerging economies of the Western Balkan countries (WB6) of Albania, Bosnia and Herzegovina (BiH), Montenegro, North Macedonia (NM), Kosovo, and Serbia have much to benefit from foreign direct investment (FDI). International flows serve as a catalyst for macro- and micro-economic growth: FDI generates capital inflow and allows host countries to expand their economies by opening their markets to higher volumes of international trade; it also stimulates domestic business competition, resulting in higher employment opportunities and growth in GDP per capita; FDI also precipitates technological shifts that call for employee training and transferable skills, ultimately contributing to the advancement of host-countries’ human capital.

Attracting greater investments from multinational enterprises (MNEs) can help the developing economies of the WB6 to instigate macroeconomic growth and ameliorate socioeconomic welfare—measures that offset the negative implications of declining GDP per capita and rising unemployment and poverty rates that currently mark the economic terrain of several WB countries. Currently, unemployment rates in the WB6 are higher than in other Balkan states and among the highest in Europe. Compared to Bulgaria and Croatia with respective unemployment rates of 3.85% and 7%, unemployment rates in year 2020 reached 12.8% in Albania and Serbia, 15% in Montenegro, 17% in NM, 18% in BiH, and approximately 25% in Kosovo[1]. This downturn has had a negative impact on poverty rates across the region, as the percentage of population living on less than $1.90 a day escalated in several WB countries in recent years[2]. Higher unemployment rates have also triggered higher emigration outflows, as WB citizens seek economic refuge in Western Europe – a phenomenon that exacerbates the region’s demographic problem and depletes the workforce needed to boost the WB6 economies[3].

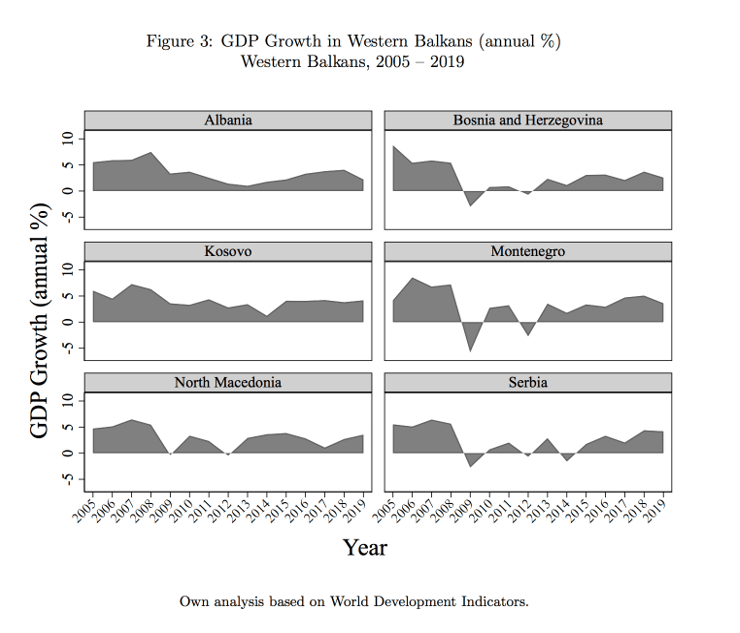

Inducing greater FDI further enables the lagging WB economies to catch up with the better-performing ones, allowing them to revive their economic pulse in ways that recapture and surpass their own post-socialist economic peaks. Current GDP per capita growth rates vary across the region: Albania, BiH, and Montenegro note a decline since 2018; Serbia and Kosovo have reached a plateau; and NM’s economy has grown relative to previous years (Figure 3). These statistics are less optimistic when assessed from a comparative perspective: even in periods of economic growth, current GDP per capita rates in several WB countries are lower than those from a decade ago. To illustrate, over the last 12 years, the annual percentage of growth rate in GDP per capita in Albania has dropped to approximately a third of the country’s 2008 growth rate of 8.3%. While the country’s economy was able to grow from 1.2% in 2013 to 4.3% in 2018, its current 2.7 percentile growth rate is only a third of the 8.3% growth rate in 2008 and is approximately 37% lower than the 4.2% growth rate that Albania reached in 2010 despite the 2008 economic crisis.

The region’s current socioeconomic conditions provide an impetus for WB governments to induce greater foreign investment as a mechanism for fostering economic development. However, regardless of common incentives to attract greater inward FDI, the WB6 governments vary in their capacity to effectively do so. This variation is driven by individual country factors owing to policy reforms to incentivize FDI, economic growth potential, and institutional measures that ensure accountability and the protection of investor rights.

Investing in FDI: Policy Measures

Recognizing the potential economic advantages of FDI, the WB6 governments have undertaken a series of policy measures, spanning the scope of business, fiscal, and legislative reforms, to establish investor rights that incentivize greater capital inflows. To this end, the Serbian government has boosted the country’s business climate by implementing legislative measures to reform the country’s labor law, privatization, and public procurement practices—efforts that helped Serbia improve its Greenfield FDI Performance Index to 11.92 in 2019, ranking it first in the list of countries most accommodating to foreign investment. Similarly, Montenegro has enacted several legislative reforms to liberalize the country’s FDI structure. Most notably, the Foreign Investment Law, implemented in 2011, annihilated investment constraints, waved customs duties, and granted foreign investors the right to repatriate profits and dividends as well as equal treatment to domestic firms. The establishment of the Montenegrin Investment Agency (MIA) and the Law on Public Private Partnerships further institutionalized these efforts, allowing Montenegro to increase its net FDI inflows to 700 million USD by year 2015[4]. Montenegro ranked second to Serbia with an 11.49 FDI Performance Index in 2019.

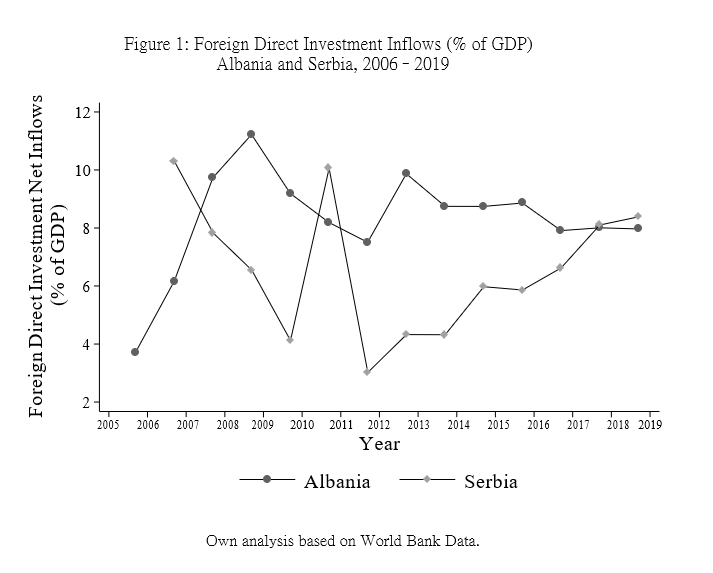

Similar measures undertaken elsewhere in the region yield more nuanced results, as the WB6 show within- and cross-country variation in the magnitude and frequency of FDI inflows. Several WB countries, including Albania, BiH, and Kosovo show incremental growth in yearly FDI net flows, yet these resources constitute a relatively small percentage of their GDP—especially when compared to the region’s other economies. For instance, the Albanian government has proactively sought to integrate its economy into the larger international structure by entering conventions for investment protection with a growing number of countries across the EU, China, and the US. Other initiatives to accommodate greater inward FDI include the ratification of the Investment Charter, policies that safeguard the equal protection of foreign investors, and tax measures, such as the VAT exemption for international exports. These measures have helped increase Albania’s net FDI inflows to 1.2 billion USD by year 2019. However, Albania’s current FDI inflow is lower than the country’s 1.3 billion inward FDI in year 2013 and compares to approximately 29% of the 4.2 billion in net FDI inflows that Serbia was able to attract in year 2019. Therefore, the temporal trend that emerges is that while Serbia’s net FDI as a percentage of GDP has steadily increased since 2012, Albania’s has been more volatile and declining since 2013. Albania’s current FDI inflows comprise 7.9% of the country’s GDP relative to the 11.1% in 2009. Figure 1 depicts the diverging trends in FDI inflows as a percentage of GDP in Albania and Serbia from 2006 to 2019.

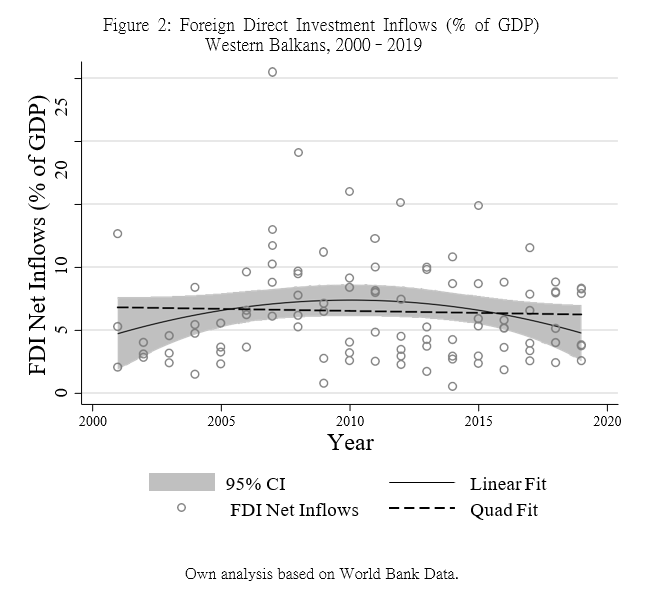

Policy measures taken by individual countries to incentivize foreign investment have helped offset the FDI deficiency that characterized the WB region during the first decade of democratic transitioning. Following a period of limited investment, owing to the political and economic instability experienced by WB countries in the immediate post-communist years, FDI inflows into the region increased substantially over the next twenty years. Whereas in year 1999 the yearly combined net FDI inflow was only 309 million USD, by 2007 approximately 9.2 billion dollars in total foreign investment was being injected into the WB economies. With the return of political stability in the following years, FDI inflows continued to grow relative to the transitioning period but remained at levels lower than 2007. Following a sharp decline in the period between 2012 (3.83 billion) and 2017 (4.73 billion), the WB6’s aggregate FDI inflows continued on an upward trend reaching 7.24 billion in 2019[5]. However, despite gains in net foreign investment, the trend of total inward FDI in proportion to the region’s GDP has been irregular and taken, as shown in Figure 2, the overall shape of a cuznet curve reaching a peak between 2007 and 2010 and continuing a downward trend in the following years. While foreign investment comprised an average of 6.1% of the region’s GDP over the period of 2000 to 2020, the overall trend is temporally sensitive, showing an upsurge in the ratio of net FDI to the region’s GDP in the early 2000s—a period that corresponds with the end of the Kosovo war and greater political stability in the region—followed by a moderate increase in the following years and a decline by year 2017 (Figure 2).

FDI: Drivers and Obstacles

Economic Factors

What drives spatial and temporal variation in FDI in the Western Balkans? The primary factors underlying distinct patterns of FDI across the region rest with individual countries’ degree of economic robustness and institutional performance. Multinational enterprises seek to invest in host-economies that provide several investing advantages, including geographic location, natural resources, distance from source economies, low production and labor costs, and labor force quality.[6] [7] [8] The WB6 share several of these features and are in a relatively favorable position to signal growth and opportunity to prospective investors: strategically located by the Adriatic, Ionian, and the Black seas, the WB6 serve as a gateway to Europe and are in close proximity to EU markets—a geographical advantage underlying China’s aim to integrate the Balkans into the “Belt and Road Initiative”. The WB6 are also rich in natural resources and offer competitive unit labor costs[9] as well as an educated workforce with multilingual skills[10]. Whereas these factors have remained either consistent or improved in recent years, the recent shift in the macroeconomic stability of several WB countries combined with the region’s dependence on external aid undercut the region’s appeal to international investors, subsequently driving heterogeneity in patterns of inward FDI. GDP growth rates have shifted in opposite directions in several WB countries over the last three years: unlike Kosovo and NM which experienced an increase in GDP growth, the rest of the WB6 have been steadily declining. In year 2019, GDP growth rates dropped to 2.21% in Albania (a 46% decline from the previous year), 1.5% in Montenegro, and 1.13% in Bosnia and Herzegovina (Figure 3).

An additional component of macroeconomic performance that further subverts the WB6’s capacity to attract FDI relates to host-economies’ dependence on external resources. The reception of foreign aid signals economic ails to potential investors and while it may have a positive impact on economic growth in the long run[11], it can also reduce capital accumulation and labor supply[12]—factors that undermine MNEs’ profitability. Therefore, a shift in host-economies’ reliance on foreign aid may alter MNEs’ investment incentives and ultimately impact the landscape of inward investment across host-economies. Table 1 shows recent trends in the net Official Development Assistance (ODA) per capita in the WB6. As shown, Albania, Montenegro, and NM have been the recipients of larger ODA payments per capita from 2016 to 2018; a decline in the amount of ODA per capita is observed in BiH, Kosovo, and Serbia—countries that show a generally upward trend in FDI inflow over the same period[13].

Table 1: Net Official Development Assistance per Capita (in current US$)

| Country | 2016 | 2017 | 2018 |

| Albania | 59.5 | 58.5 | 119.6 |

| Bosnia and Herzegovina | 131.7 | 131.4 | 105.76 |

| Kosovo | 208.1 | 219 | 191.9 |

| Montenegro | 137.8 | 189.3 | 248.8 |

| North Macedonia | 80.9 | 72.02 | 81.57 |

| Serbia | 89.7 | 240.5 | 152.9 |

Data Source: World Development Indicators.

Institutional Structures

In addition to macroeconomic factors, host-economies’ political and institutional conditions further drive variation in the WB6’s capacity to appeal to multinational enterprises. Firms seek to optimize returns by investing in countries that grant firm-specific[14] or ownership advantages[15] with limited costs. These preferences are primarily met in politically stable and conflict-free states with institutional structures that offer not only established accountability and transparency mechanisms, but also an efficient judiciary that can arbitrate and uphold MNE investor rights.

Political stability is especially key in attracting inward FDI. Contrary to politically volatile environments which risk a breakdown in trade agreements and investor rights, politically stable countries signal continuity and profitable returns to potential investors, thereby increasing their own appeal as remunerative host-economies. In the Balkans, the period following the November 1995 Dayton Accords, which negotiated a peace agreement between Bosnia, Croatia, and Serbia, and the end of the late 1990s Kosovo war was followed by a seven fold upsurge in the region’s capital FDI inflows increasing from 101 million dollars in 1996 to 795 million in 2001.

The prospect of EU membership, currently pursued by the WB6, serves as an impetus for institutional changes that invite greater FDI to the region. Albania and NM’s recent reopening of EU accession talks, Serbia and Montenegro’s opening of several EU accession chapters, and BiH and Kosovo’s EU aspirations, call for policy measures that foster development and prospective growth. Depending on their individual progress in the EU accession continuum, the WB6 can signal to foreign investors—with distinct levels of strength and credibility—the premise of macroeconomic reforms, improved fiscal discipline and financial stability, and prospective legal changes to improve the domestic business environment.

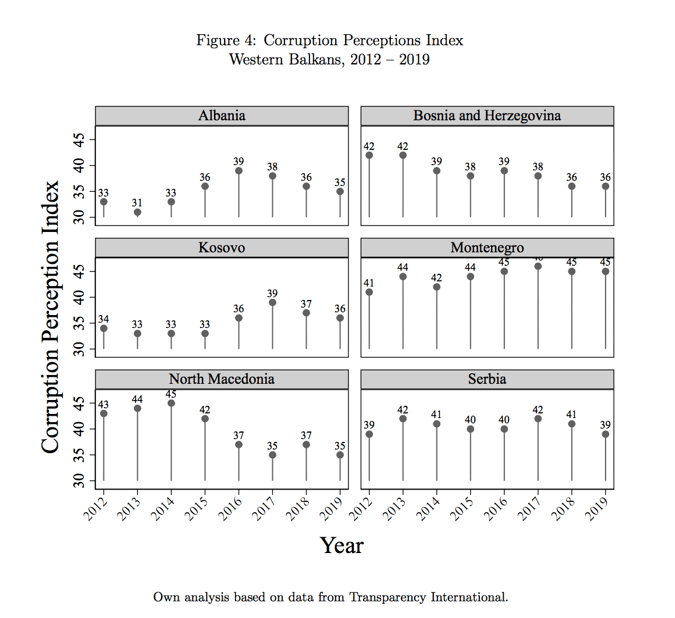

Transparency and accountability are also crucial features of host-countries’ political environments that can either precipitate or hinder investment inflows. Unlike institutions with liable accountability mechanisms, institutional structures inflicted by corruption impede FDI by heightening business uncertainties and raising investment costs for potential investors.[16] [17] Corruption is not an absolute deterrent for FDI, and highly corrupt countries, such as Mexico, Brazil, and several African states, have been able to successfully attract FDI despite their corruption tendencies[18]. However, a corrupt business environment generates bureaucratic delays and operational inefficiencies that deter investors—particularly investors from developed and highly accountable economies who are unfamiliar or unapt to operate under corrupt conditions[19]. Corruption also triggers the rise of informal economies and grants preferential access to profitable markets to certain companies over others—factors that subvert investment returns and disincentivize prospective investors. How do these factors play out in the Western Balkans? The business climate of WB countries, which has been consistently plagued by corruption and lack of accountability in the post-communist era, has deteriorated further since 2016. As captured by the Corruption Perceptions Index (CPI)—a Transparency International index that ranks the degree of corruption in a given country—there has been a general downward trend in CPI scores across the WB6 in recent years. Placing countries in a continuum of 0 (highly corrupt) to very clean (100), CPI scores show that WB countries have fallen below the world average score of 43 in recent years. Figure 4 shows that Albania, which consistently ranks as one of Europe’s most corrupt countries, marks the biggest drop in CPI scores since 2016 (from 39 to 35), followed by BiH and Kosovo (from 39 to 36), and North Macedonia (from 37 to 35). Montenegro and Serbia, which fair comparatively higher than their WB counterparts in the CPI index have also shown a greater capacity to attract greater FDI inflows into their economies. These trends are positively correlated to countries’ business climates: out of 180 economies, Albania and Bosnia and Herzegovina ranked, respectively, 82 and 90 in 2020 Doing Business Report, well below Serbia (44) and Montenegro (50) which provide investors with a comparatively less corrupt business climate.[20]

Rule of law and efficient judiciary systems are also key drivers of the WB6′ capacity to motivate FDI. Whereas weak or malfunctioning legal institutions generate corruption and conflict over competing interests, robust legal and judiciary systems facilitate FDI in important ways: they institutionalize MNEs’ legal privileges, such as property rights, investment freedom, and equal treatment relative to domestic firms; they also protect MNEs against political influences over competing interests and have the power to implement and enforce laws that uphold investor privileges. The WB6 have taken a series of legislative measures and fiscal reforms to foster investment. Across the region, countries have implemented laws that protect investor rights and ensure their national treatment while also prohibiting discriminatory legal or business practices against them. Specifically, Montenegro’s 2011 Foreign Investment Law, Serbia’s 2015 The Law on Investments, Albania’s ratification of the Investment Chapter, and similar legislative measures adapted by other WB countries constitute government efforts — in the form of custom duty waivers, the right to repatriate profits and dividends, and legal protection against sudden expropriation—to foster greater inward FDI.

Conclusions

Despite these measures however, the WB6 show limited administrative capacity to credibly implement accountability and transparency measures. Foreign investors across the region encounter lengthy bureaucratic delays, a lack of transparency in public procurement, and inefficient judiciaries that are influenced by government officials and political interests[21]. Thus, regardless of the written laws on investor rights, the judiciary systems of WB states show limited efficiency and expediency to adjudicate business conflicts in a timely and unbiased manner. These shortcomings are directly correlated to investor perceptions of the business climate in WB countries and offer insight into the recent decline in general patterns of FDI in Western Balkan countries.

In order to advance from emerging to more developed economies, WB governments must engage with practical and diagnostic policy measures that accommodate greater inbound FDI. Globally competitive firms can effectively strengthen WB economies via transferable skills, capital, and knowledge, empowering host-countries to shift from low to higher value-added activities within global value chains. However, the onus to incentivize MNEs to invest in the Western Balkans falls on the region’s governments. A necessary condition—well recognized by the WB6—is to implement FDI promotion measures, including tax incentives and subsidized production inputs. These policies however are necessary, but not sufficient. The process of fostering FDI and economic growth goes beyond the formal adaptation of policy and legislative measures that acknowledge investor rights. It also calls for specific, systematic measures to revamp under-performing areas of domestic economies in ways that signal growth and profitability to potential investors. Promoting inward investment also calls for mending institutional structures to facilitate operational and production efficiency for current and prospective investors. And, importantly, given the WB6’s high degree of executive and public corruption[22], efforts to boost FDI inflows call for concrete metrics to increase accountability and limit governments from influencing the regulations balance between domestic and foreign investors for personal or political gains. The prospective benefits are multiple: boosting economic performance through FDI can help the WB6 reduce unemployment, poverty, and emigration rates, allowing Western Balkan countries to foster sustainable economic growth, improve social welfare, and maintain their long-term demographic integrity.

Albana Shehaj is a Postdoctoral Research Scholar at the Center for European Studies at Harvard University. Dr. Shehaj holds a Ph.D. in Political Science and Methodology from the University of Michigan. Her research focuses on international political economy with an emphasis on distributive politics, democratization, corruption, and the lending policies of international organizations (IMF, the EU, and the World Bank). Dr. Shehaj’s work has appeared or is forthcoming in Party Politics, Economics and Politics, European Policy Analysis, and the Review of International Organizations.

[1] The World Bank. World Bank indicators. https://data.worldbank.org/ indicator/ (2020).

[2] From 2016 to 2017, the percentage of population living on less than $1.90 a day increased

from 1.1% to 1.7% in Albania and from 4.1% to a 4.4% in North Macedonia.

[3] Tim Judah. Bye-bye, Balkans: A region in critical demographic decline (October 14, 2019). https://balkaninsight.com/2019/10/14/bye-bye-balkans-a-region-in-critical-demographic-decline/. Online; Accessed 28-September-2020.

[4] The World Bank. World Bank indicators. https://data.worldbank.org/ indicator/ (2020).

[5] The World Bank. World Bank indicators. https://data.worldbank.org/ indicator/ (2020).

[6] A. A. Bevan and S. Estrin. The determinants of foreign direct investment into european transition economies. Journal of comparative economics (2004)32 (4), 775–787.

[7] J. H. Dunning. Location and the multinational enterprise: a neglected factor? Journal of international business studies (1998)29 (1), 45–66.

[8] W. Hejazi and P. Pauly. Motivations for FDI and domestic capital formation. Journal of International Business Studies (2003) 34 (3), 282–289.

[9] P. Sanfey, J. Milatovic, and A. Kresic How the Western Balkans can catch up. (2016).

[10] UNESCO, Education database.

[11] V. Levy. Aid and growth in sub-saharan Africa: The recent experience. European Economic Review (1988) 32 (9), 1777–1795.

[12] G. Mallik. Foreign aid and economic growth: A co-integration analysis of the six poorest African countries. Economic Analysis & Policy (2008). 38 (2).

[13] The World Bank. World Bank indicators. https://data.worldbank.org/ indicator/ (2020).

[14] A. M. Rugman. New theories of the multinational enterprise. New York: St. Martins Press. Rugman New Theories of the Multinational Enterprise. 1982.

[15] J. H. Dunning and S. M. Lundan. Multinational enterprises and the global economy. Edward Elgar Publishing 2008.

[16] R. Grosse and L. J. Trevino. New institutional economics and FDI location in Central and Eastern Europe. MIR: Management International Review, (2005) 123–145.

[17] Mohsin Habib and Leon Zurawicki. Corruption and foreign direct investment. Journal of international business studies (2002) 33 (2), 291–307.

[18] Mohsin Habib and Leon Zurawicki. Corruption and foreign direct investment. Journal of international business studies (2002) 33 (2), 291–307.

[19] W. H. Davidson. The location of foreign direct investment activity: Country characteristics and experience effects. Journal of international business studies (1980)11 (2), 9–22.

[20] https://www.doingbusiness.org/content/dam/doingBusiness/media/Profiles/ Regional/DB2020/ECA.pdf

[21] Saul Estrin and Milica Uvalic. “FDI into transition economies: are the Balkans different?” Economics of transition (2014) 22 (2), 281–312.

[22] Albana Shehaj. “The perils of succor: The financial role of the European Union in the Western Balkans during Covid-19.” European Policy Analysis, 2020.